This article provides a brief overview of Zakat/Tax return in Saudi Arabia along with general measures targeted specifically to provide relief for taxpayers by easing tax return filing and tax payment requirements for a limited time in response to the coronavirus (COVID-19). This article also includes instructions of How/when to file Zakat/Tax return in Kingdom of Saudi Arabia.

General Extension for Zakat/Tax Return 2020

Saudi Arabia: Zakat/Tax return latest update

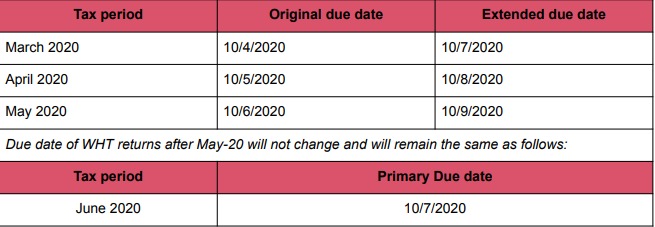

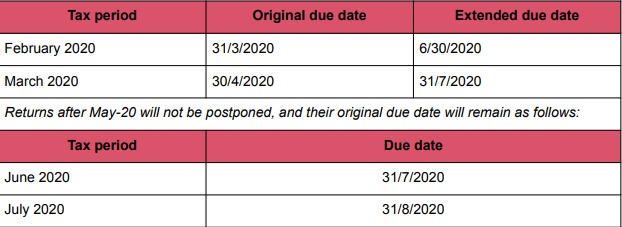

The General Authority for Zakat and Tax (GAZT) introduced a general extension for filing tax returns and payment the related tax for registered taxpayers. GAZT has extended tax return deadline for Zakat/tax returns due by April 29, 2020 for the year ending December 31, 2019 could be filed without any penalty on or before July 29, 2020. The extension is applicable to all returns with due date falling between March 19, 2020 and June 30, 2020.

Return Filings

Zakat/taxpayers are required to file annual tax/zakat declaration in Arabic within 120 days of the end of the financial year of the company. A tax return should be submitted along with

- Audited financial statements

- Social insurance payment certificate

- Break-up of purchases made during the period

- Annual withholding tax

- Other detailed account of affairs

- Saudi Arabia income taxpayer and mixed (Income tax and Zakat) entities having transactions with Related Parties or transactions of “effective control” with certain third parties would also need to make certain Transfer Pricing (TP) related filings along with their tax return. Transfer Pricing By-laws (TP By-laws) have been introduced in Saudi Arabia effective for tax periods ended December 31, 2018 and onwards

- Disclosure Form for Controlled Transaction (DFCT) along with a Chartered Accountant’s Affidavit declaring that the Transfer Pricing policy of the group is required to be submitted along with the annual tax return for Saudi Arabia taxpayers having Related Party Transactions.

Transfer Pricing in Saudi Arabia by GAZT

Taxpayers with controlled transactions exceeding SAR 6 million during the fiscal year will need to prepare the reports and make them available to the GAZT upon request. Saudi Arabia taxpayers would need to maintain full-fledged Transfer Pricing Documentation consisting of Master File & Local File. If a Saudi Arabia taxpayer (Income tax, Zakat or mixed entity) is part of a group having consolidated annual group revenues exceeding SAR 3.2 billion in the preceding fiscal year, they would also need to submit a Country-by-Country Report (‘CbCR’) as part of the DFCT above.

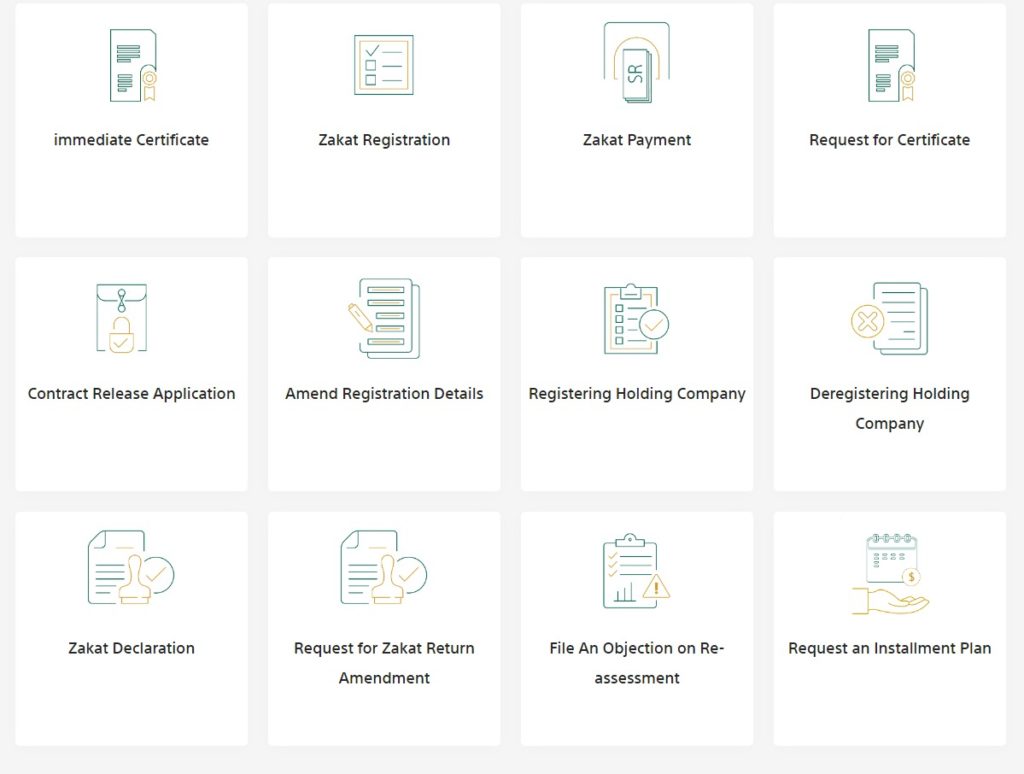

How to submit tax/zakat returns?

The GAZT implemented the online electronic filing system. As per the system, it is mandatory for all zakat/taxpayers, including mixed companies (companies owned by Saudi and foreign shareholders) and fully owned foreign companies to submit their tax/zakat returns electronically. The only prerequisite for submitting Tax return is to be registered in Zakat & Income Tax e-portal.Not registered yet?Click here

- As a registered user login to Zakat and Income Tax Department e-portal.Click here to login

- Select required tax return from Tax Return Service

- Read and accept instructions

- Upload supporting documents and click SUBMIT

- Tax return delivery acknowledgement will be issued

E-Service Portal

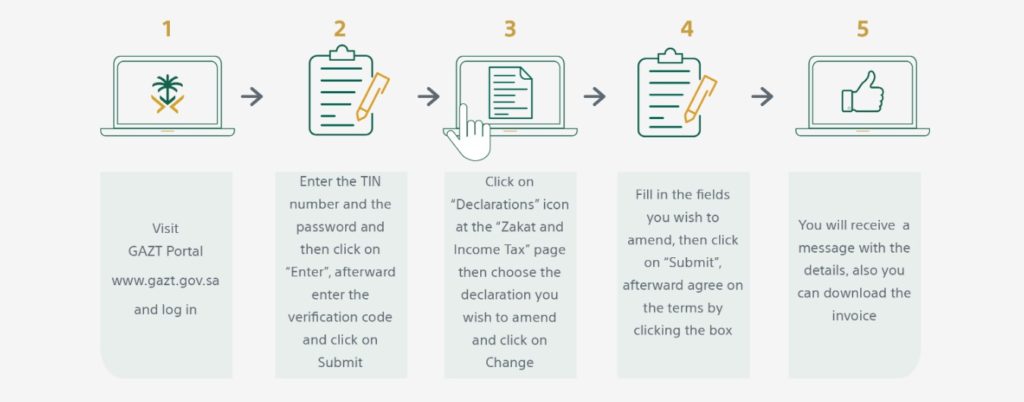

Zakat/Tax Return Amendment

To file an amended declaration, zakat and income taxpayers should seek the GAZT’s approval by completing an application through the GAZT’s electronic filing system. The request for filing an amended return should provide justifications or reasons and supporting documents for such filing.The GAZT will review the taxpayer’s request and, if appropriate, reopen the declaration for the revision. The amended return shall be subject to the GAZT’s normal review process.

Delay Fines & Penalties

The GAZT imposes delay fines if there is a delay in submitting the tax declaration and late settlement of income tax beyond the prescribed deadline under the Saudi Arabia Income Tax Law.